Safer cold storage on Ethereum

Your exchange’s cold storage is only as secure as its weakest assumption. While the industry has relied on Bitcoin-era, unprogrammable cold storage solutions for over a decade, these approaches fundamentally underestimate Ethereum’s capabilities. By using smart contract programmability, exchanges can build custody solutions that remain secure even when multisig keys are compromised.

At EthCC[8], our Director of Engineering for Blockchain, Benjamin Samuels, makes the case for greater use of smart contracts when cold-storing funds on Ethereum that moves beyond the limitations of traditional key management.

The fatal flaw in traditional cold storage

Traditional cold storage operates on a dangerous premise: if you control the keys, you control the funds. This creates catastrophic single points of failure:

- Simple multisig: Compromise M-of-N keys → drain everything

- Blind-signing risks: The signers accidentally sign a malicious transaction → total loss

- Supply chain risks: The multisig provider’s front end is compromised → game over

Even sophisticated multisignature setups suffer from the same fundamental weakness: they’re all-or-nothing security models. Once an attacker obtains the threshold of keys, no amount of operational security can prevent total fund loss.

A better way: Self-protecting smart contract wallets

Ethereum enables a fundamentally different approach. Instead of relying solely on key security, we can program wallets to enforce security policies at the protocol level. The core design principle should be constrained functionality: instead of using generic wallet contracts, use purpose-built contracts that perform only specific, predefined actions. Here’s an example:

// DON'T: Generic execution allows arbitrary actions. Many multisig solutions have functions like this in their contracts. Don't store funds there.

function execute(address target, bytes calldata data) external onlyMultiSig {

(bool success,) = target.call(data);

require(success, "Execution failed");

}

// DO: Constrained functions with built-in security policies

function transferToHotWallet(

address hotWallet,

address token,

uint256 amount

) external

onlyOpsMultisig

onlyWhitelistedReceivers(hotWallet)

rateLimited(token, amount)

afterTimelock

{

IERC20(token).safeTransfer(hotWallet, amount);

...

}By preventing wallet contracts from blindly executing whatever the multisig requests, we can apply security controls and policies to the multisig’s actions, improving the system’s defense-in-depth and overall security posture.

Implementing defense in depth

To protect your cold storage infrastructure, it’s important to have multiple layers of security controls, also known as defense in depth. We discuss several of these strategies in greater detail in Maturing your smart contracts beyond private key risk.

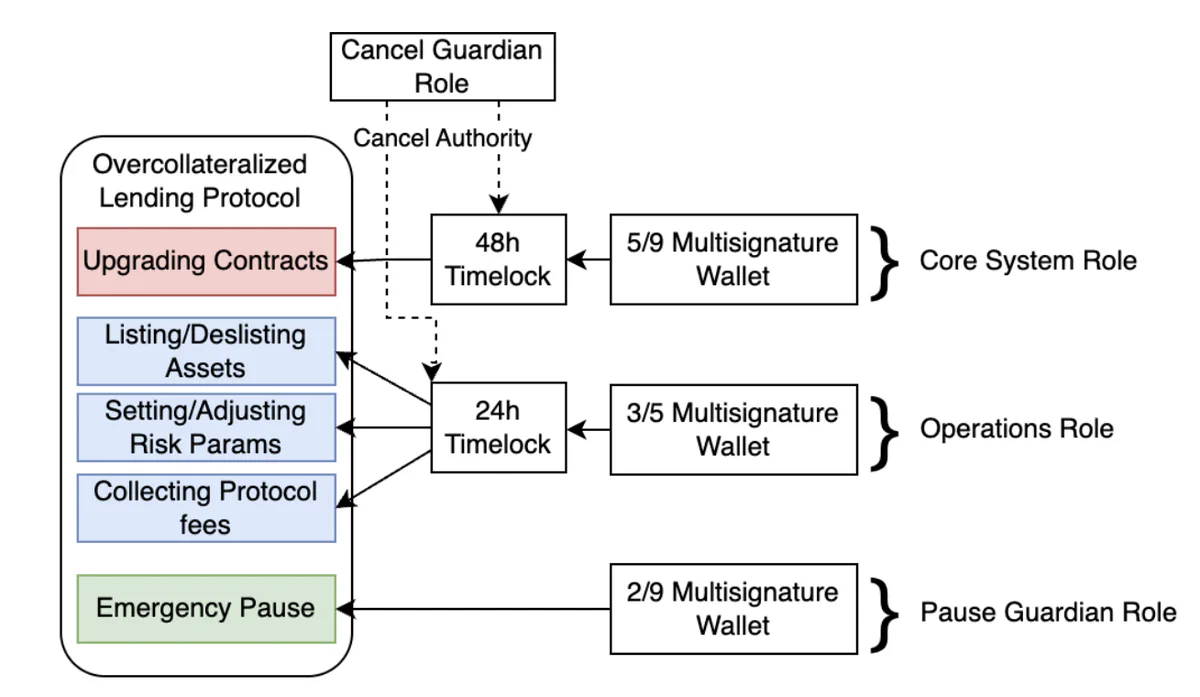

1. Role-separated multisignature architecture

Implement two distinct multisigs with strictly separated privileges:

Configuration multisig

- Highly secure, rarely accessed keys (potentially geographically distributed)

- Can modify only wallet policies (allowlist, limits, timelocks)

- Cannot directly move funds

- Requires higher threshold (e.g., 4-of-7)

Operations multisig

- Can only execute transfer functions for pre-approved addresses

- Cannot modify security policies

- Lower threshold for operational efficiency (e.g., 2-of-3)

This separation ensures that even complete compromise of one of the two multisigs cannot bypass security policies.

2. Timelocked operations with active monitoring

All critical actions should enforce mandatory delays. Here is a model for these timelocked operations. This provides a critical window for incident response teams to detect and prevent malicious transactions.

This corresponds to maturity level 3 in the aforementioned blog post.

3. Progressive rate limiting

Implement rate limits that are right-sized for your exchange’s risk tolerance, ability to reimburse funds, and expected utilization frequency for transferring funds out of cold storage.

One good example of a rate limiter used in practice is Chainlink’s CCIP RateLimiter.sol. This bucket-based rate limiter slowly fills a “bucket” for each token at a specified rate until the bucket is full. When capacity is consumed, it is deducted from the bucket’s balance. This approach allows effective rate limiting and the ability to consume large amounts of capacity (up to the bucket limit) in quick bursts.

Emergency response mechanisms

You’ll want to make sure that your exchange has an emergency response plan and monitoring infrastructure that can detect and enable your team to respond to incidents involving cold wallet infrastructure. In a normal multi-signature setup, once the malicious transaction is executed on-chain, there is no opportunity for an incident response team to minimize damage.

Cold storage wallets should use time-lock mechanisms that can be used by monitoring infrastructure to reconcile on-chain activity with expected cold wallet activity, and trigger an incident response if a discrepancy is detected.

Using a time-lock also enables incident response teams to cancel malicious transactions before they are executed, completely mitigating any loss.

Security analysis: Attack scenarios

Let’s say your system is attacked: an attacker compromises one or both of the multisigs, or they discover and exploit a bug in your smart contracts. Here’s what the damage would look like for a traditional multisig compared to a well-designed, policy-enforcing wallet.

| Attack scenario | Damage for a traditional multisig | Damage to policy-enforcing wallet |

|---|---|---|

| Ops multisig compromised | Total fund loss | Limited to daily rate limits and allowlisted addresses. Potentially no impact if the malicious transaction is cancelled by the timelock guardian. |

| Config multisig compromised | Total fund loss | Can only add, remove, or modify rate limit config. Cannot steal funds without compromising an allowlisted address. Potentially no impact if the malicious transaction is cancelled by the timelock guardian. |

| Both keys compromised | Total fund loss | Maximum loss limited by timelock and rate limits. Potentially no impact if the malicious transaction is cancelled by the timelock guardian. |

| Smart contract bug | N/A | Depends on bug severity; risk of bugs can be mitigated using simple, well-tested contracts. |

As the table shows, use of a self-protecting wallet that implements the defense-in-depth measures described above results in significantly less monetary loss after a multisig compromise or bug exploitation.

Getting started

To implement this approach, do the following:

Audit your current architecture: Map all possible fund movement paths. Constrain them with policies wherever possible.

Design your constraints: Define appropriate allowlists, rate limits, and timelocks.

Implement monitoring: Build systems to detect and respond to timelock events.

Test incident response: Practice emergency procedures before you need them.

Get audited: Have your implementation reviewed by security experts.

Secure your cold storage

By leveraging Ethereum’s programmability, exchanges can build cold storage systems that are resilient to key compromise. The key insight is simple: don’t just protect your keys; program your wallet to protect itself.

These patterns are not anything new. In fact, they have been used for years in production by leading DeFi protocols managing billions in TVL. It’s time for centralized exchanges to adopt the security innovations that DeFi has pioneered.

The era of all-or-nothing key security is over. Build systems that fail gracefully, limit damage, and give your security team time to respond. Your users’ funds depend on it.

For more on smart contract security and custody solutions:

- Follow Benjamin Samuels on X: @thebensams

- Watch: The $1.5B Problem: How Exchanges Can Build Safer Cold Storage

- Read: The Custodial Stablecoin Rekt Test

- Read: Maturing your smart contracts beyond private key risk